South African local data and the budget speech did not sit well with many, while U.S. Federal minutes emphasised that interest rates would remain higher due to sticky inflation. At the same time, this is information that was widely expected. The ZAR remains constrained by international developments, particularly from impulses of the U.S. narrative.

Last week's critical data concerned the SARB's leading indicator, consumer price inflation and unemployment. The SARB leading indicator index was lower for the second month, highlighting tighter economic conditions in the coming months. Additionally, unemployment showed that 16.7 million people remain out of jobs, equating to 32.10% Q/Q, up from 31.90%. Despite the challenging economic climate, core inflation, which excludes food and energy goods, was marginally higher, with fuel-keeping headline inflation closer to the SARB upper target band at 5.3%.

This week, focus will be given to the South African trade balance data. From a technical perspective, Rand came under tremendous pressure last week, losing 2.9% against the dollar. The rand weakness will be dictated by U.S. core PCE data reading later this week, which could impulse price toward the upper resistance level should the reading be higher than the anticipated 2.8% Y/Y and 0.4% M/M.

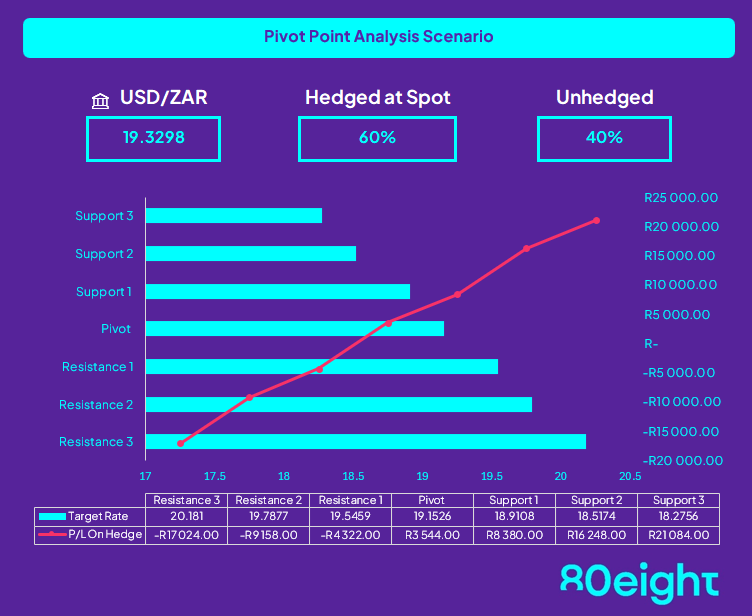

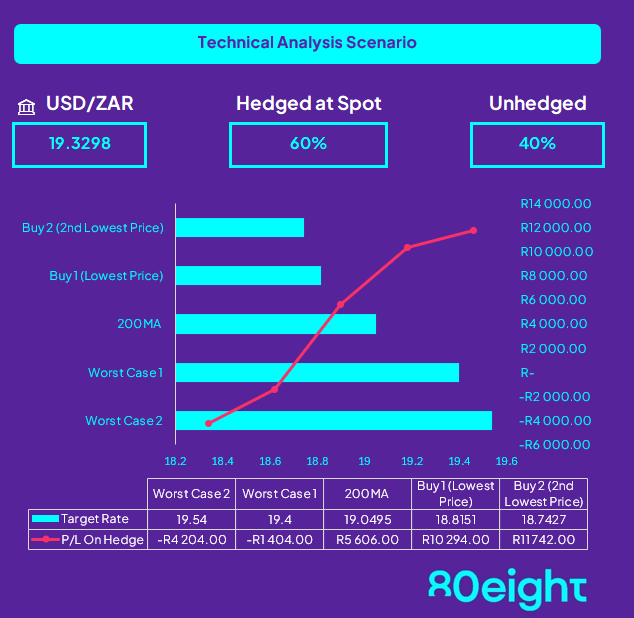

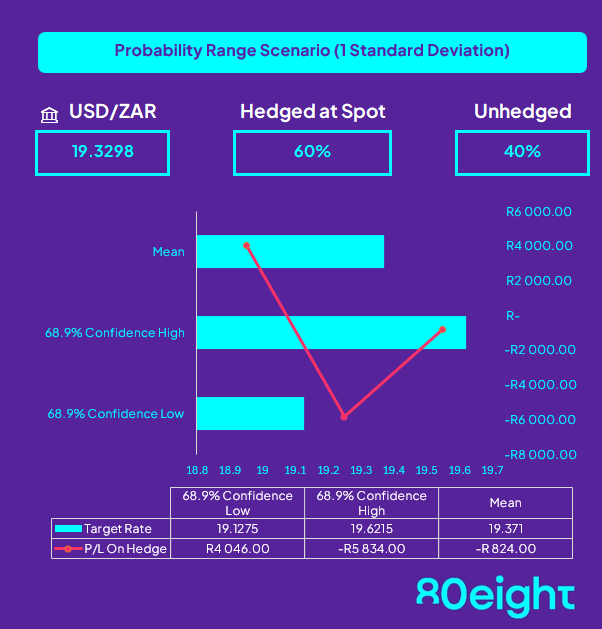

The data below emphasises hedge scenarios based on a USD50,000 invoice on a 60/40 split vs. an outright hedge.

Insights by: Shiven Moodley (COO & Macro Strategist)